Vea también

10.06.2025 06:40 AM

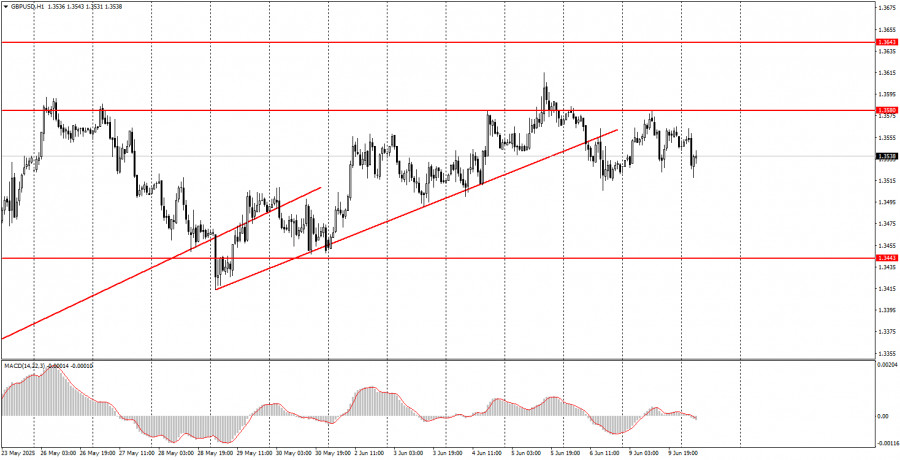

10.06.2025 06:40 AMThe GBP/USD pair also traded in both directions on Monday. On Friday, the price consolidated below the ascending trendline, formally changing the trend to bearish. Formally—because we saw something similar a week ago when the pound sterling also consolidated below the previous ascending trendline. At that time, however, we didn't see any significant decline in the pair. Thus, the current fundamental background suggests that a new decline in the dollar can be expected at any moment—even if a buy signal is formed or the trend has turned downward. The market doesn't want to deal with a currency whose country's president regularly attends court, takes strange and unconstitutional actions, fuels trade conflicts, and fails to fulfill campaign promises. The U.S. economy is currently teetering on the edge of recession, but no one knows what new tariffs Donald Trump might introduce or raise. As the saying goes, don't count your chickens before they hatch.

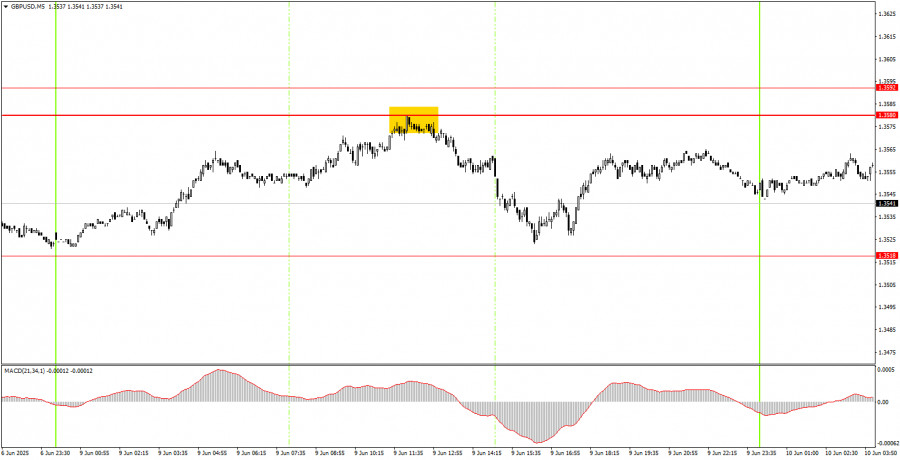

One very good sell signal was formed in the 5-minute timeframe on Monday. During the European trading session, the pair bounced off the 1.3580 level and then dropped almost to the 1.3518 level, which was the nearest target. Unfortunately, this level wasn't clearly tested, but the trade could have been closed manually at any time. It still would have yielded a profit for novice traders.

In the hourly timeframe, the GBP/USD pair continues to respond solely to Trump and still views his policies skeptically. Some signs of de-escalation in trade tensions are present, but the market isn't brimming with optimism, while there are far more signs of renewed escalation. Therefore, as before, the market uses every opportunity to sell the dollar rather than buy it. This will continue until the market sees real signs of the end of the trade war and Trump stops making decisions beyond his authority.

On Tuesday, the GBP/USD pair may continue a mild downward movement (since the price did consolidate below the trendline) unless Trump once again prevents the dollar from strengthening.

On the 5-minute timeframe, the levels for trading are: 1.3043, 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3421–1.3443, 1.3518, 1.3580–1.3592, 1.3652–1.3660, 1.3695.

No significant events are scheduled in the U.S. for Tuesday, while the UK will publish reports on unemployment, jobless claims, and wages. These are not the most critical data, and market reaction is only likely in case of forecast deviations.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Análisis del par GBP/USD 5M. El par de divisas GBP/USD durante el miércoles, a diferencia del par EUR/USD, continuó tranquilamente su movimiento hacia el Norte. Durante el día no hubo

Análisis del par EUR/USD 5M. El par de divisas EUR/USD durante el miércoles no mostró ningún movimiento interesante, y el mercado no mostró ningún interés en los acuerdos comerciales

Ayer se formaron varios puntos de entrada al mercado. Vamos a ver el gráfico de 5 minutos y entender qué ocurrió. En mi pronóstico de la mañana presté atención

Ayer se formaron varios puntos de entrada al mercado. Vamos a ver el gráfico de 5 minutos y entender qué pasó allí. En mi pronóstico de la mañana presté atención

El par de divisas GBP/USD también continúa su movimiento ascendente durante el martes. La nueva caída de la moneda estadounidense puede intentarse vincular con el discurso de Jerome Powell, como

El par de divisas EUR/USD durante el martes permaneció inmóvil durante la primera mitad del día y en la segunda mitad se negoció al alza. En la segunda mitad

Ayer se formaron varios puntos de entrada al mercado. Vamos a mirar el gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico de la mañana presté atención

El par GBP/USD mostró el lunes exactamente los mismos movimientos que el par EUR/USD. Por lo tanto, es evidente que en todo el mercado el dólar estadounidense comenzó una nueva

El par de divisas EUR/USD aparentemente completó el lunes una tendencia bajista de tres semanas. Recordemos que durante al menos las últimas dos semanas, desde Estados Unidos llegaba una gran

El viernes pasado se formó solo un punto de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico de la mañana, presté

Video de entrenamiento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.