Vea también

09.06.2025 05:54 AM

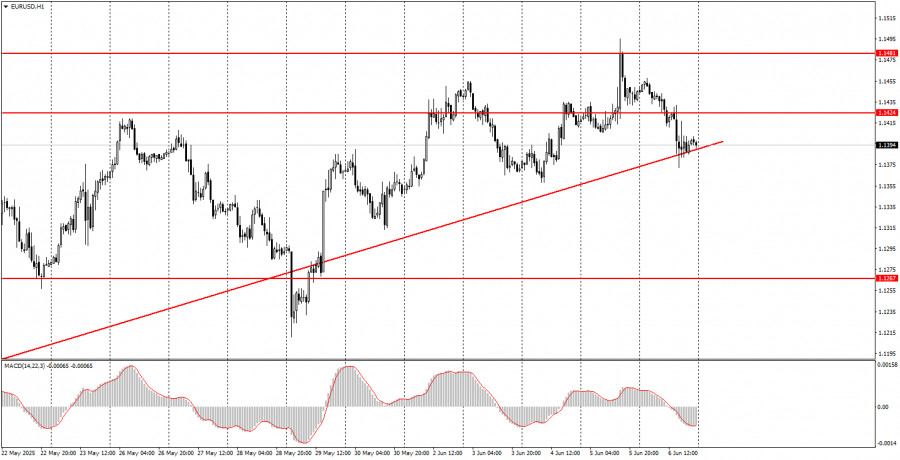

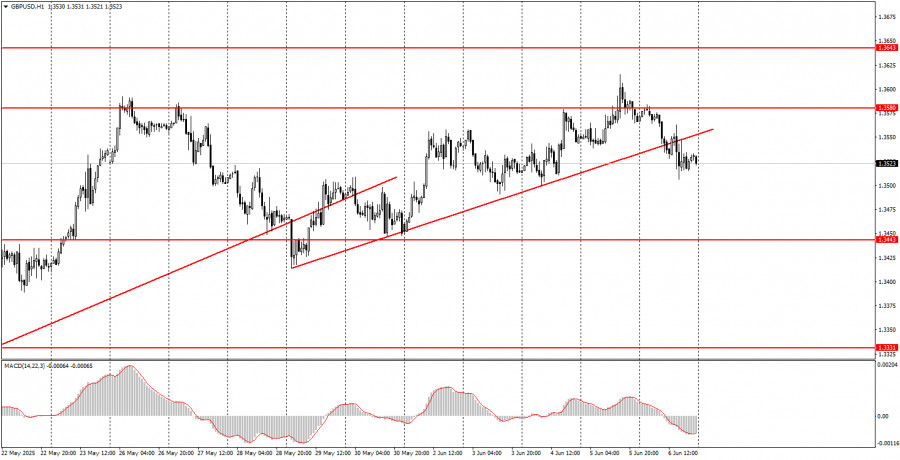

09.06.2025 05:54 AMNo macroeconomic reports are scheduled for Monday. Thus, traders will have nothing to react to during the day. There is a high probability of flat or weak movements unless Donald Trump makes new high-profile statements that shock the markets. The euro is close to breaking through the ascending trendline again, and the British pound has already done so. However, the fundamental background related to the trade war remains much more important than technical signals. Trump can easily trigger a new collapse of the dollar at any moment.

There is absolutely nothing noteworthy among Monday's fundamental events. The European Central Bank meeting has already taken place, and the Bank of England and Federal Reserve meetings are scheduled for later, but they also carry no intrigue. Both central banks are expected to leave key interest rates unchanged with a 90% probability.

We believe the market still only cares about the ongoing trade war, which continues to escalate. The dollar's decline could continue if trade agreements with most countries are not signed before the grace period expires, which ends in about a month. The dollar may keep falling even without new tariffs from Trump, as the market's attitude toward the US president and his policies remains extremely negative. The International Trade Court decided to block Trump's tariffs, but on the same day, the Court of Appeals overturned this decision. Shortly afterward, it was announced that tariffs on steel and aluminum imports would be raised.

On the first trading day of the new week, both currency pairs will trade based on technical factors. Low volatility and flat movement are possible since there will be no macroeconomic data that day.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Durante el pasado fin de semana, el presidente estadounidense D. Trump y la presidenta de la Comisión Europea U. von der Leyen anunciaron la consecución de un acuerdo comercial entre

El par de divisas el par GBP/USD cayó bastante el viernes. Esta caída de la libra británica genera cierta perplejidad, ya que no hubo razones de peso para ello

El par de divisas EUR/USD continuó el viernes con un movimiento descendente suave y débil. Como ya hemos mencionado muchas veces, el movimiento actual es una corrección en estado puro

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.