Vea también

03.06.2025 06:27 AM

03.06.2025 06:27 AMThe EUR/USD currency pair traded higher on Monday. We had warned that the dollar would likely decline again after Trump announced increased tariffs on steel and aluminum imports. Consequently, EUR/USD moved upward. On Monday, the price climbed almost all day, with the movement starting overnight. Essentially, the tariff hike signals another escalation of the trade war. Since the US dollar has been declining on this factor for several months while ignoring virtually all other factors, what else could have been expected on Monday? Also, several manufacturing PMI indices for Germany, the EU, and the US were published yesterday; however, they did not affect overall trader sentiment. Macroeconomic data, as a whole, are currently of limited interest. Nonetheless, it's worth noting that the most important ISM index in the US came out weaker than forecast, adding further pressure on the dollar.

At the start of the European trading session on Monday, a perfect buy signal was formed in the 5-minute timeframe. The price rebounded from the 1.1354–1.1363 area, leading to growth toward the 1.1413–1.1424 zone. A semblance of a flat market followed, but there were hardly any false signals. The price resumed growth from the 1.1413–1.1424 area, although this movement was relatively weak.

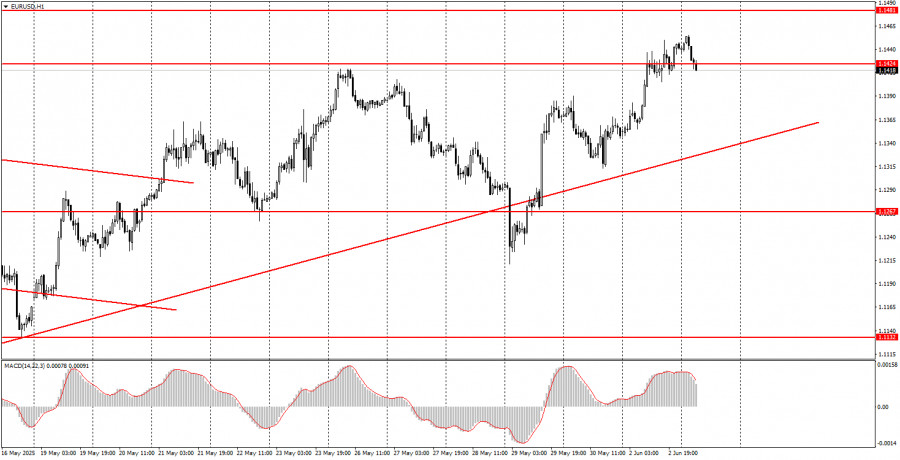

In the hourly timeframe, the EUR/USD pair has broken through the ascending trendline; however, the uptrend that started during Donald Trump's presidency continues. The fact that Trump is still the US president is enough for the dollar to keep falling. For the market, that's already a compelling reason to flee from the dollar. If Trump continues to threaten, issue ultimatums, and impose/raise tariffs, the market will have few alternatives. Trump's tariffs have not been canceled, so the trade war situation has not improved.

On Tuesday, the EUR/USD pair could move in either direction since Trump's tariff hikes have already been priced in. Thus, today's trading should be based on technical factors — unless Trump announces new tariffs.

On the 5-minute timeframe, the following levels should be considered: 1.0940–1.0952, 1.1011, 1.1088, 1.1132–1.1140, 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622. Inflation data for May is set to be released in the Eurozone on Tuesday; however, it is not anticipated to significantly impact the market at this time. The European Central Bank is almost certain to cut rates on Thursday, which is not expected to affect the euro negatively. The JOLTs job openings report will be published in the US, but it also holds little significance for the market — especially under current conditions.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Análisis del par GBP/USD 5M. El par de divisas GBP/USD durante el miércoles, a diferencia del par EUR/USD, continuó tranquilamente su movimiento hacia el Norte. Durante el día no hubo

Análisis del par EUR/USD 5M. El par de divisas EUR/USD durante el miércoles no mostró ningún movimiento interesante, y el mercado no mostró ningún interés en los acuerdos comerciales

Ayer se formaron varios puntos de entrada al mercado. Vamos a ver el gráfico de 5 minutos y entender qué ocurrió. En mi pronóstico de la mañana presté atención

Ayer se formaron varios puntos de entrada al mercado. Vamos a ver el gráfico de 5 minutos y entender qué pasó allí. En mi pronóstico de la mañana presté atención

El par de divisas GBP/USD también continúa su movimiento ascendente durante el martes. La nueva caída de la moneda estadounidense puede intentarse vincular con el discurso de Jerome Powell, como

El par de divisas EUR/USD durante el martes permaneció inmóvil durante la primera mitad del día y en la segunda mitad se negoció al alza. En la segunda mitad

Ayer se formaron varios puntos de entrada al mercado. Vamos a mirar el gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico de la mañana presté atención

El par GBP/USD mostró el lunes exactamente los mismos movimientos que el par EUR/USD. Por lo tanto, es evidente que en todo el mercado el dólar estadounidense comenzó una nueva

El par de divisas EUR/USD aparentemente completó el lunes una tendencia bajista de tres semanas. Recordemos que durante al menos las últimas dos semanas, desde Estados Unidos llegaba una gran

El viernes pasado se formó solo un punto de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico de la mañana, presté

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.