Vea también

05.05.2025 04:15 AM

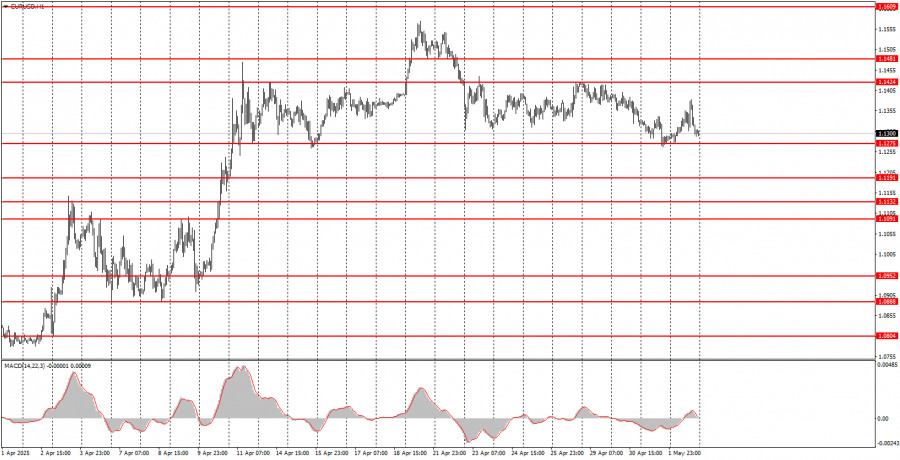

05.05.2025 04:15 AMOn Friday, the EUR/USD currency pair continued to trade within the sideways channel between 1.1275 and 1.1424. In principle, there is little to add, as the macroeconomic background was again ignored, and the movements were erratic and chaotic. Nothing changed in the market on Friday. The only notable point is the rebound from the 1.1275 level, which we had previously highlighted. This level marks the lower boundary of the sideways channel, so a bounce from it was expected to trigger an upward movement. However, no strong growth followed, as the U.S. labor market and unemployment data came out better than expected. NonFarm Payrolls for April amounted to 177,000 compared to a forecast of 130,000. The unemployment rate remained unchanged at 4.2%. There was, however, a slight blemish: the March NFP figure was revised down from 228,000 to 185,000. The data package turned out to be neutral, although the dollar had been bracing for worse figures.

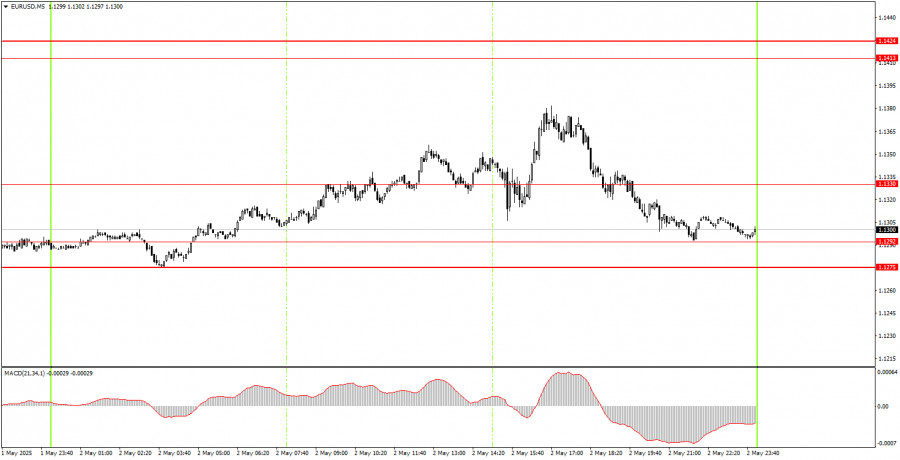

No valid trading signals were formed on Friday in the 5-minute timeframe. First, the market has remained in a range for over three weeks. Second, price action remains chaotic. Price is not responding to technical levels, and the market ignores macroeconomic data. Therefore, expecting quality signals remains difficult. While isolated trading days may offer entry opportunities, Friday was not one of them.

The EUR/USD pair maintains a bullish trend on the hourly timeframe. Excluding the movements at the beginning of last week, the market has been in a sideways range near the highs for three weeks. Market sentiment remains extremely negative toward the U.S. dollar and U.S.-related developments. However, if Trump shifts toward de-escalating the trade conflict he initiated, the dollar may regain some strength. When or if that happens remains unknown.

On Monday, the pair could move in either direction again, as all market activity still hinges on Trump's statements and decisions. Since there has been little news from Trump recently, we believe the sideways movement will likely continue. A rebound from the lower boundary of the range (1.1275) could lead to a new upward movement.

On the 5-minute timeframe, the following levels should be monitored: 1.0940–1.0952, 1.1011, 1.1091, 1.1132–1.1140, 1.1189–1.1191, 1.1275–1.1292, 1.1330, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622, 1.1666, 1.1689. No significant events are scheduled in the Eurozone on Monday, and in the U.S., only the ISM Services PMI will be released. As we have already seen, the market barely reacts to macroeconomic data.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel

Ayer se formó solo un punto de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención al nivel

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos que ocurrió. En mi pronóstico matutino presté atención al nivel 1.3555 y planeé

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos que ocurrió. En mi pronóstico matutino presté atención al nivel 1.1416 y planeé

GBP/USD: plan para la sesión europea del 2 de junio. Informes COT (Commitment of Traders) (análisis de las operaciones de ayer). La libra no cesa en sus intentos de subir

El pasado viernes se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió allí. En mi pronóstico matutino presté atención

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino, presté atención al nivel 1.3545

Ayer se formaron varios puntos de entrada al mercado. Veamos el gráfico de 5 minutos y analicemos lo que ocurrió. En mi pronóstico matutino, presté atención al nivel 1.1374

Para abrir posiciones largas en el par GBP/USD se requiere: La libra esterlina continúa fortaleciéndose, y las recientes decisiones de EE. UU. en relación con los aranceles comerciales le están

Para abrir posiciones largas en el par EUR/USD se requiere: Las noticias de que Trump pospuso la introducción de aranceles elevados a productos de la UE hasta

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.