Vea también

02.05.2025 12:17 PM

02.05.2025 12:17 PMTrade Analysis and Advice for the Euro

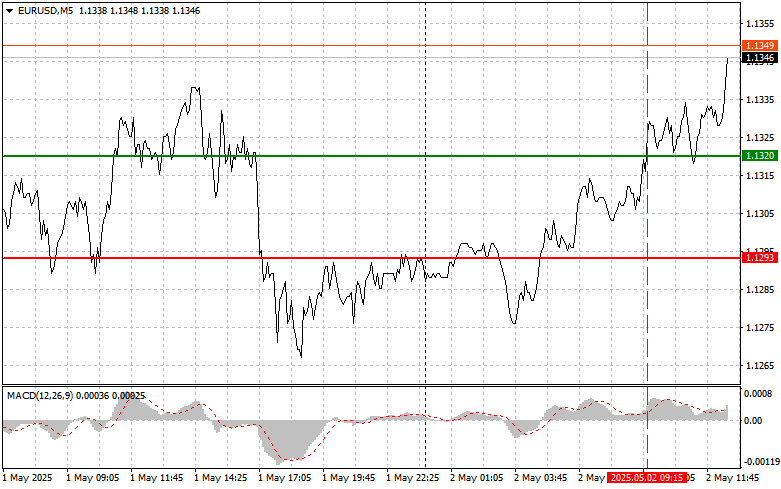

The test of the 1.1320 price in the first half of the day occurred at a time when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro.

It is very likely that April's nonfarm payrolls data from the U.S. will fall short of even the most pessimistic forecasts. A significant slowdown in job growth is expected, which may indicate deepening economic challenges in the U.S. economy. Preliminary macroeconomic indicators have already signaled a decline in activity across various sectors. The ADP report was a clear confirmation of that.

A negative trend in the labor market may provide further grounds for a more dovish Federal Reserve policy. Given the key role of consumer spending in the economy, a reduction in jobs may lead to decreased demand and slower economic growth. Considering Trump's tariff policies, it's unlikely the weak data will prove temporary.

As for the intraday strategy, I will rely mainly on the implementation of Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro upon reaching the price area of 1.1361 (green line on the chart), targeting a rise toward 1.1413. I plan to exit the market at 1.1413 and sell the euro in the opposite direction, expecting a 30–35 point movement from the entry point. A euro rally can be expected following weak data and continuation of the trend. Important! Before buying, make sure that the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the 1.1314 price level at a time when the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. Growth to opposite levels of 1.1361 and 1.1413 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1314 level (red line on the chart). The target will be the 1.1241 level, where I will exit the market and immediately buy in the opposite direction (expecting a 20–25 point movement in the opposite direction from the level). Pressure on the pair may return today in the event of very strong labor market data from the U.S. Important! Before selling, make sure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.1361 level at a time when the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A drop to the opposite levels of 1.1314 and 1.1241 can be expected.

What's on the chart:

Important Notice

Beginner Forex traders must be extremely cautious when deciding to enter the market. It's best to stay out of the market ahead of important fundamental reports to avoid sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, your entire deposit can be lost quickly—especially if you don't use money management and trade large volumes.

And remember, successful trading requires a clear trading plan—like the one I've presented above. Spontaneous decision-making based on current market conditions is, by nature, a losing strategy for intraday traders.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Análisis de operaciones y consejos para operar con el yen japonés La prueba del precio 155.96 coincidió con el momento en que el indicador MACD apenas comenzaba a moverse hacia

Análisis de operaciones y consejos para operar con la libra esterlina. La primera prueba del precio 1.2184 en la segunda mitad del día coincidió con el momento

Análisis de las operaciones y consejos para operar con el euro. La prueba del precio 1.0282 en la segunda mitad del día coincidió con el momento en que el indicador

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.