Lihat juga

09.06.2025 12:55 AM

09.06.2025 12:55 AMIn the United States, as usual, there will be far more interesting events and news than in the Eurozone or the United Kingdom. Economic data will start arriving on Wednesday with the release of the inflation report. Let me remind you that while this report is undoubtedly important, in recent months, the Federal Reserve has not been making monetary policy decisions based on inflation figures. The FOMC continues to monitor the state of the economy and the labor market and is still waiting for the full effects of tariffs on the U.S. economy. Since the final tariffs on imports into the U.S. for 75 countries have not yet been determined, it is impossible to draw definitive conclusions about the trade war's impact on the economy. Therefore, the Fed will continue to wait, regardless of what the inflation numbers for May show. The next Fed meeting is scheduled for June 18.

The U.S. will also see the release of the Producer Price Index and the Consumer Sentiment Index. However, these reports will likely interest only the most devoted fans of statistics. Much greater interest lies in the ongoing confrontation between figures like Donald Trump and Elon Musk. The billionaire and the multi-billionaire have started openly clashing this week, each trying to win over as many voters and consumers as possible. Their sparring primarily takes place through the media and social networks. Elon Musk is reportedly considering creating a third U.S. political force to compete with Democrats and Republicans. Undoubtedly, this will take a lot of time, but for now, Musk intends to support the Democrats and oppose the Republicans.

The actions taken by Musk and Trump against each other also draw significant attention. I believe that the more such actions we see, the less the market will desire to increase demand for the dollar. That desire is already near zero, but it could sink even lower. In general, the main focus for the upcoming week will be on the Musk-Trump conflict rather than U.S. inflation.

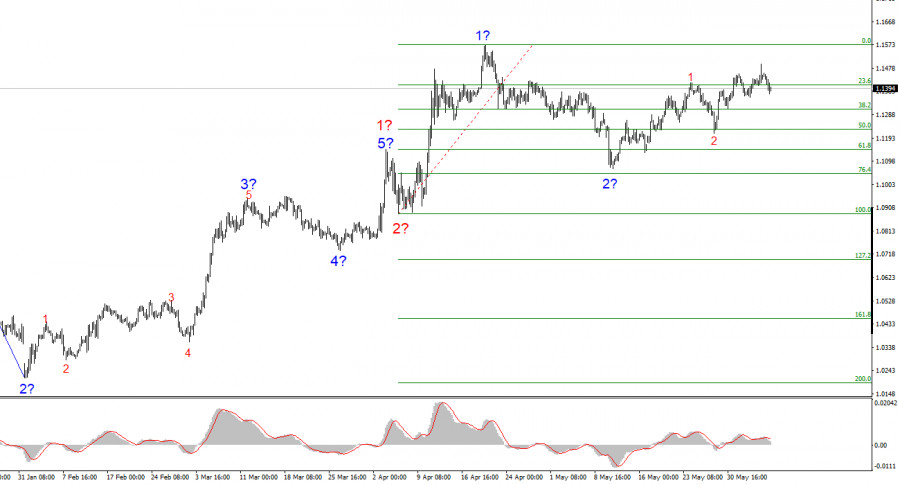

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. In the near term, the wave structure will entirely depend on the news background related to Trump's decisions and U.S. foreign policy. The formation of wave 3 of the upward trend segment has begun, and its targets may extend up to the 1.2500 area. Therefore, I am considering buying positions with targets above 1.1572, which corresponds to 423.6% of Fibonacci's retracement and is even higher. It should be noted that de-escalation of the trade war could reverse the uptrend, but for now, there are no signs of a reversal or de-escalation.

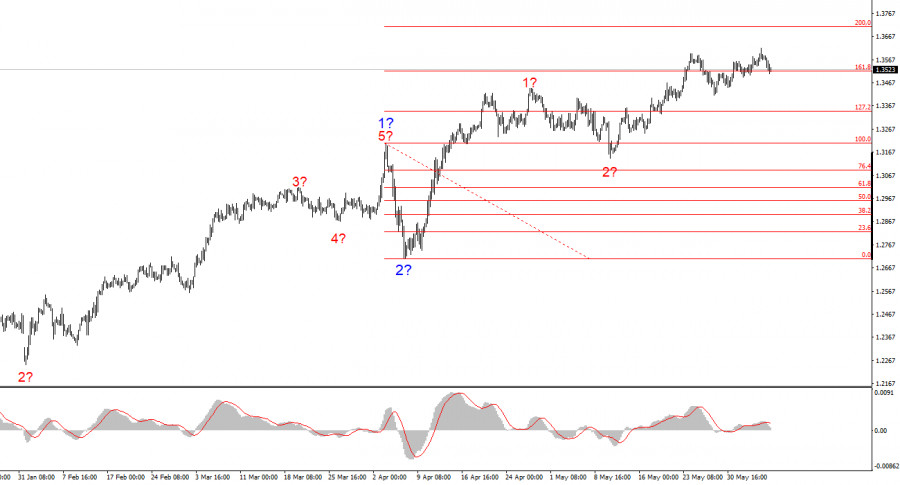

The wave structure of the GBP/USD instrument has changed. We are now dealing with an upward, impulsive segment of the trend. Unfortunately, under Donald Trump, the markets may face many more shocks and reversals that do not correspond to any wave structure or type of technical analysis, but for now, the working scenario and structure remain intact. The formation of an upward wave 3 continues with the nearest target at 1.3708, corresponding to 200.0% Fibonacci of the presumed global wave 2. Therefore, I am still considering buying positions, as the market has yet to show a desire to reverse the trend.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Laporan inflasi yang diterbitkan pada hari Selasa memperkuat ekspektasi pelaku pasar bahwa bank sentral AS akan menurunkan suku bunga pada pertemuan bulan September, membuka jalan bagi pertumbuhan berkelanjutan di pasar

Hanya ada satu rilis makroekonomi yang dijadwalkan pada hari Rabu — estimasi kedua inflasi Jerman untuk bulan Juli. Di Uni Eropa, estimasi kedua umumnya tidak berbeda dari yang pertama, inflasi

Pada hari Selasa, pasangan mata uang GBP/USD kembali diperdagangkan dengan cukup lemah. Di pagi hari, Inggris merilis data pengangguran dan upah, tetapi angka-angka tersebut terlalu "datar." Pada dasarnya, hanya laporan

Pada pasangan mata uang EUR/USD, perdagangan kembali berlangsung dengan cukup tenang. Meskipun pasangan ini tidak sepenuhnya terjebak di tempat, volatilitas tetap rendah. Saat ini tidak ada rentang sideways yang jelas

Pada hari Selasa, dolar menerima kabar positif pertamanya dalam beberapa minggu terakhir. Pasar sudah melupakan bahwa Donald Trump dengan cerdik menandatangani perjanjian dagang dengan Jepang dan Uni Eropa karena pada

Laporan pertumbuhan CPI AS mencerminkan stagnasi dalam inflasi utama dan laju dalam inflasi inti. Namun, rilis ini diinterpretasikan terhadap dolar — pasangan EUR/USD sekali lagi mendekati batas atas area 1.17

Untuk membangun sesuatu yang baru, Anda harus meruntuhkan segalanya terlebih dahulu. Inilah prinsip yang diikuti Donald Trump dalam merestrukturisasi sistem perdagangan internasional. Akibatnya, prinsip-prinsip yang telah teruji selama puluhan tahun

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Aplikasi baru kami untuk verifikasi yang mudah dan cepat

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.