Lihat juga

30.05.2025 06:37 AM

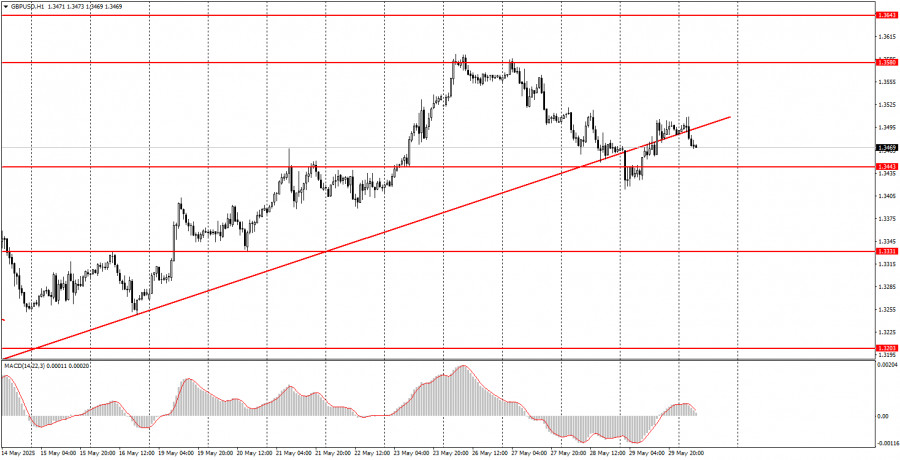

30.05.2025 06:37 AMOn Thursday, the GBP/USD pair showed movements similar to the EUR/USD pair but with lower volatility. The ascending trendline was breached, so from a technical point of view, a further decline in the pair and a strengthening of the dollar should be expected. Are there fundamental reasons for this? It's a tough question because the market continues ignoring many factors favoring the U.S. dollar. Yesterday, it became known that the court suspended Donald Trump's tariffs against half of the world's countries, but by the evening, the court had also suspended its decision to lift Trump's tariffs. Thus, the situation with the Global Trade War has not changed. From the current levels, the dollar can also continue its decline since not much is needed for that right now. It's best to rely on technical signals and setups because it is extremely difficult to understand which direction the market favors.

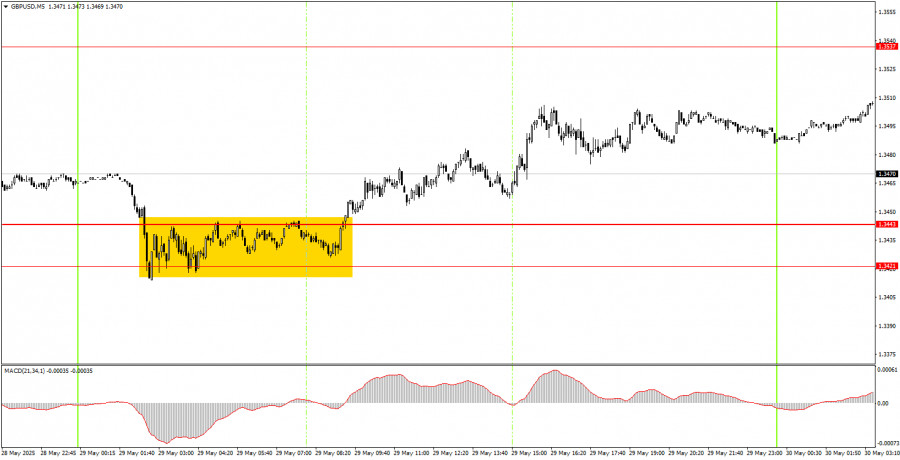

On Thursday, a good trading signal was generated in the 5-minute timeframe. At the beginning of the European trading session, the price broke out of the 1.3421–1.3443 area, so novice traders could have opened long positions. The British pound continued to rise for the rest of the day, although not too strongly. It didn't reach the nearest target, so the long position could have been closed manually anywhere in the evening.

In the hourly timeframe, the GBP/USD pair continues to follow developments around Donald Trump and remains quite skeptical about his policies. Some signs of easing trade tensions are present, but the market does not feel a surge of optimism about this. The dollar strengthened this week, but it is merely a technical correction that could continue. We would not risk declaring a full-fledged dollar trend even after breaking the trendline.

The GBP/USD pair might resume moving south on Friday since the trendline was breached. However, few fundamental factors support such a movement. We remain skeptical about the dollar's growth, but at the moment, it's better to trade based on technical factors.

For the 5-minute timeframe, trading levels to consider are 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3203–1.3211, 1.3259, 1.3329–1.3331, 1.3421–1.3443, 1.3537, 1.3580–1.3592, 1.3652–1.3660, and 1.3695.

No significant events are scheduled for Friday in the UK, and in the U.S., reports on personal income and spending, the PCE price index, and the University of Michigan Consumer Sentiment Index will be released. We do not believe these reports will provoke a strong market reaction.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada akhir hari Senin, pasangan GBP/USD juga menunjukkan pergerakan naik yang cukup kuat. Kenaikan ini dimulai selama sesi trading AS, tepat ketika sebagian besar trader sudah kehilangan harapan akan adanya

Pada hari Senin, pasangan mata uang EUR/USD menunjukkan pergerakan yang cukup kuat. Awalnya, volatilitas pasar tidak terlalu tinggi, meskipun aliran berita mungkin saja memicu "lonjakan" sejak malam hari. Namun, pergerakan

Pada hari Senin, pasangan mata uang GBP/USD trading dengan cara yang berbeda dari yang diharapkan. Banyak yang memperkirakan lonjakan kuat pada dolar AS, penurunan tajam, atau pergerakan harga yang "seperti

Pada hari Senin, pasangan mata uang EUR/USD menunjukkan sedikit penurunan yang diikuti oleh kenaikan yang relatif kuat. Penguatan dolar jauh lebih rendah dari yang diharapkan banyak trader. Ingat bahwa pada

Dalam prediksi pagi saya, saya fokus pada level 1,3438 dan merencanakan keputusan trading berdasarkan level tersebut. Mari kita lihat grafik 5 menit dan menganalisis yang terjadi. Kenaikan dan pembentukan penembusan

Dalam prediksi pagi, saya fokus pada level 1,1505 dan merencanakan keputusan trading berdasarkan level tersebut. Mari kita lihat grafik 5 menit dan analisis apa yang terjadi. Terbentuk breakout dan pengujian

Pada hari Jumat, pasangan GBP/USD diperdagangkan dengan cukup lemah dan tidak pasti. Kami tidak dapat secara pasti mengatakan bahwa tren menurun telah berakhir, tetapi kami juga tidak dapat mengatakan bahwa

Pada hari Jumat, pasangan mata uang EUR/USD mengakhiri pergerakan turunnya. Seperti yang kami prediksi, penguatan dolar sangat singkat. Pasar masih belum melihat alasan untuk membeli mata uang AS bahkan dalam

Pada hari Jumat, pasangan mata uang GBP/USD awalnya naik sebelum jatuh, tetapi poin pentingnya ditemukan di tempat lain. Sementara euro mempertahankan tren naik pada kerangka waktu per jam dan menunjukkan

Pada hari Jumat, pasangan mata uang EUR/USD diperdagangkan dengan sangat lemah dan bergerak menyamping. Tidak ada pendorong makroekonomi atau fundamental pada hari itu, sehingga pasar memasuki akhir pekan lebih awal

InstaTrade dalam angka

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.