Lihat juga

01.05.2025 06:50 AM

01.05.2025 06:50 AMThere are relatively few macroeconomic events scheduled for Thursday, but that no longer matters much. Yesterday, there were plenty of important publications from the Eurozone, Germany, and the U.S. Even without the German reports, we still had Eurozone and U.S. GDP data, the ADP report, and the PCE index. All of these reports were ignored. U.S. statistics disappointed, yet the dollar rose throughout the day. Yes, the rise was weak, but the macro data should have supported the euro. Especially since Eurozone GDP grew by 0.4% in Q1, and for the first time in a while, it showed stronger growth than the U.S. GDP. Thus, the ISM Manufacturing PMI, which is generally considered quite important, has very little chance of influencing the movement of major pairs today.

Fundamental Events Breakdown:

There's still no point in discussing anything other than Trump's trade war when it comes to fundamental factors. The dollar's decline can continue for as long as Trump keeps introducing new tariffs and increasing old ones. Any escalation could trigger another dollar sell-off. Any de-escalation could strengthen the dollar. The U.S. President has started to soften his rhetoric toward China, but this is not yet de-escalation. Knowing Trump, we wouldn't be surprised if he raises tariffs again right after announcing tariff cuts for China.

Donald Trump stated that he doesn't plan to maintain tariffs on China at 145%, which sparked a wave of relief in all markets. However, the dollar showed no optimism in response. The market sees no concrete signs of de-escalation and thus is in no rush to buy the U.S. dollar. Even on Monday, when there was no news at all, the market preferred selling the dollar. Meanwhile, on Wednesday — when U.S. statistics collapsed — the dollar rose. There's still little logic behind these movements.

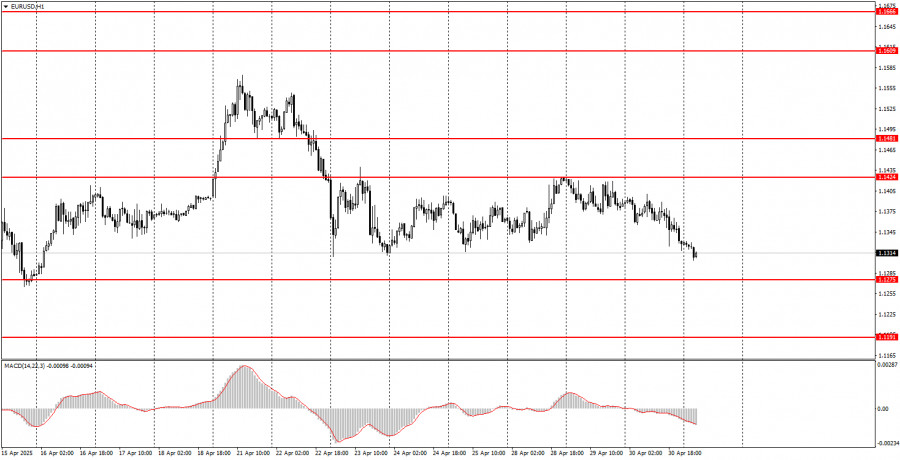

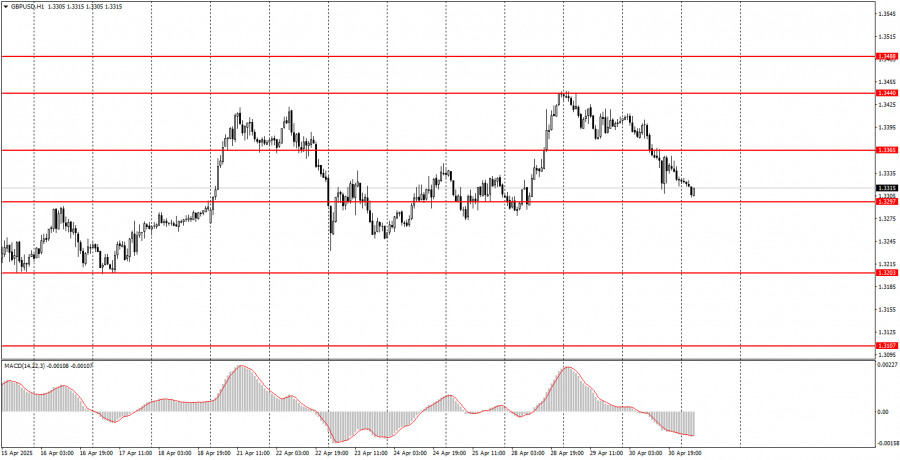

General Conclusions: During the penultimate trading day of the week, both currency pairs could move in either direction. For the euro, a flat trend may continue, so a rebound from the 1.1275 level could trigger another upward phase. The British pound still shows more desire to grow, but it has now declined for two days in a row. The macroeconomic background is 90% unlikely to influence traders' sentiment.

Basic Rules of the Trading System:

What's on the charts: Price support and resistance levels – levels that serve as targets when opening buy or sell trades. Take Profit levels can be placed near them.

Red lines – channels or trendlines that show the current trend and indicate the preferable trading direction.

MACD indicator (14,22,3) – histogram and signal line – a supporting indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can significantly influence currency pair movement. Therefore, during their release, it is advisable to trade with maximum caution or exit the market to avoid sharp price reversals against the preceding trend.

Beginner Forex traders should remember that not every trade will be profitable. Developing a clear strategy and sound money management is the key to long-term trading success.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pada pasangan USD/CAD terus mengalami penurunan. Faktor fundamental mendukung sentimen bearish, menunjukkan bahwa jalur dengan level resistance paling rendah untuk harga spot tetap ke bawah. Laporan tentang perjanjian perdagangan antara

Pasar telah naik untuk hari ketiga berturut-turut, menafsirkan situasi saat ini sebagai ketidakpastian perdagangan yang meluas — jauh dari kehancuran pasar. Ini memungkinkan pandangan yang lebih tenang dan rasional. Keadaan

Hanya ada sedikit laporan makroekonomi yang dijadwalkan untuk hari Kamis. Hanya dua laporan sekunder dari Inggris dan AS yang akan diterima para trader hari ini. Laporan aktivitas sektor konstruksi secara

Pada hari Rabu, pasangan mata uang GBP/USD diperdagangkan dengan cukup tenang, karena hanya ada sedikit peristiwa dan laporan penting sepanjang hari. Seperti yang kami perkirakan, indeks aktivitas bisnis (tidak termasuk

Pada hari Rabu, pasangan mata uang EUR/USD diperdagangkan dengan sangat tenang. Seperti yang kami sebutkan kemarin, tidak ada alasan untuk mengharapkan indeks aktivitas bisnis memengaruhi perdagangan — terutama indeks aktivitas

Pada hari Kamis, European Central Bank akan mengumumkan hasil dari pertemuan berikutnya. Meskipun hasil formal dari pertemuan bulan Juni hampir dapat dipastikan, prospek masa depan untuk pelonggaran kebijakan moneter lebih

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.