Lihat juga

30.04.2025 01:18 PM

30.04.2025 01:18 PMTrade Analysis and Tips for Trading the Euro

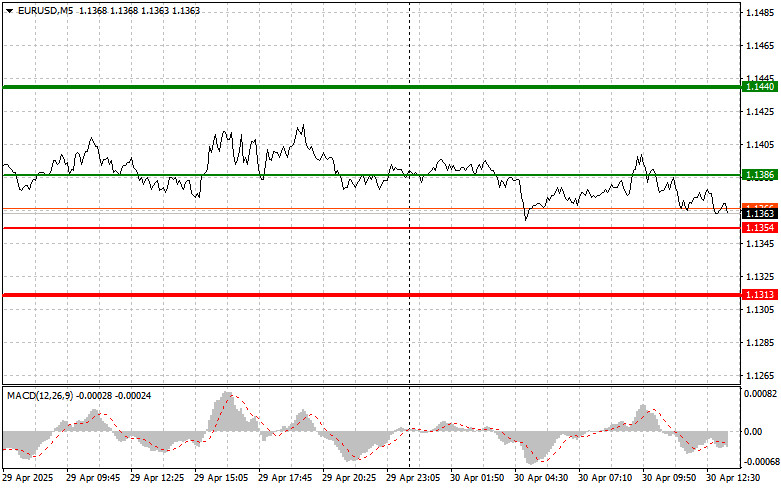

The test of the 1.1386 price in the first half of the day coincided with the MACD indicator having already moved far above the zero mark, which limited the pair's upward potential. For this reason, I did not buy the euro. I did not see any other market entry points either.

Recent data indicated that eurozone GDP grew by 0.4% in the first quarter of this year. This figure exceeded analysts' forecasts but failed to generate interest among holders of the European currency. Such disregard for positive information may negatively impact the pair's bullish prospects later this week, especially ahead of key U.S. statistics.

Traders' attention will be focused on upcoming data concerning U.S. employment and economic growth. Today promises to deliver a wealth of information that could significantly influence market sentiment and forecasts for the Federal Reserve's future monetary policy. First in line is the ADP employment report for April. This report is traditionally used as a meaningful indicator of labor market conditions, helping to assess employment trends in the private sector. Results above expectations could signal economic resilience, thereby increasing inflationary pressures and strengthening the U.S. dollar.

However, a more important event will be the release of preliminary data on U.S. GDP growth for the first quarter of this year. This figure is a key indicator of the overall state of the economy, reflecting the pace of economic expansion. It is expected that the data will point to a slowdown compared to the previous quarter, possibly due to a combination of factors including inflation, interest rates, and geopolitical instability. Lastly, a crucial addition to all reports will be the Personal Consumption Expenditures (PCE) index. This index is the Federal Reserve's preferred measure of inflation, reflecting changes in prices of goods and services consumed by households. A rise in the PCE could prompt the Fed to maintain its cautious stance regarding interest rate adjustments.

As for the intraday strategy, I will rely primarily on the implementation of Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro upon reaching the entry point around 1.1386 (green line on the chart), aiming for a rise to 1.1440. At 1.1440, I plan to exit the market and also sell the euro in the opposite direction, anticipating a 30–35 point move from the entry point. A euro rally can be expected in line with the trend and following weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and just starting to rise from it.

Scenario #2: I also plan to buy the euro today in the case of two consecutive tests of the 1.1354 level when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a market reversal upward. A rise toward the opposite levels of 1.1386 and 1.1440 can be expected.

Sell Signal

Scenario #1: I plan to sell the euro after reaching the 1.1354 level (red line on the chart). The target will be the 1.1313 level, where I plan to exit the market and immediately buy in the opposite direction, anticipating a 20–25 point move from the level. Pressure on the pair will likely return today if there is no buyer activity near the daily high. Important! Before selling, make sure the MACD indicator is below the zero mark and just starting to decline from it.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1386 price level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. A decline toward the opposite levels of 1.1354 and 1.1313 can be expected.What's on the chart:

Important. Beginner traders in the Forex market must be very cautious when making market entry decisions. Before the release of key fundamental reports, it is best to stay out of the market to avoid being caught in sharp price movements. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can very quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

And remember, successful trading requires a clear trading plan — like the one presented above. Spontaneous trading decisions based on current market conditions are, by default, a losing strategy for any intraday trader.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Uji harga di 144.06 bertepatan dengan saat ketika indikator MACD baru saja mulai bergerak turun dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual dolar. Akibatnya, pasangan ini jatuh

Pengujian harga di 1,3529 pada paruh kedua hari bertepatan saat indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli pound. Akibatnya, pasangan

Uji level harga 1,1396 bertepatan dengan saat indikator MACD baru saja mulai bergerak naik dari garis nol. Ini mengonfirmasi titik entri yang tepat untuk membeli euro, menghasilkan kenaikan lebih dari

Ulasan Trading dan Tips untuk Trading Yen Jepang Pengujian harga di 144.01 pada paruh pertama hari terjadi ketika indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik

Ulasan Trading dan Kiat-kiat untuk Trading Pound Inggris Pengujian harga di 1,3526 pada paruh pertama hari terjadi ketika indikator MACD baru saja mulai bergerak naik dari titik nol, mengonfirmasi titik

Ulasan dan Kiat-kiat untuk Trading Euro Pengujian harga di 1,1382 terjadi ketika indikator MACD baru saja mulai bergerak naik dari level nol, mengonfirmasi titik entri yang tepat untuk membeli euro

Uji harga di 143.12 terjadi ketika indikator MACD sudah bergerak naik secara signifikan dari level nol, yang membatasi potensi kenaikan pasangan ini. Karena alasan ini, saya tidak membeli dolar

Uji harga di 1.3502 terjadi pada sore hari ketika indikator MACD sudah bergerak turun secara signifikan dari titik nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual

Uji harga pada 1,1395 bertepatan dengan indikator MACD, yang telah bergerak turun secara signifikan dari level nol, membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual euro. Ekonomi

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.