Lihat juga

31.03.2025 09:07 AM

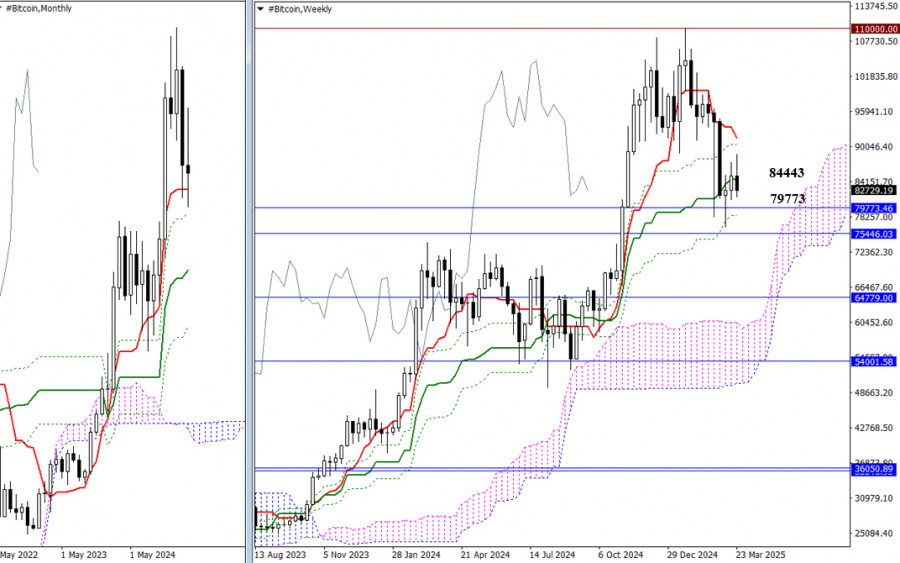

31.03.2025 09:07 AMUncertainty currently dominates the market. Participants have taken a wait-and-see approach. The support of the monthly short-term trend at 79,773 and the weekly medium-term trend at 84,443 continue to influence the situation. To shift the current setup, bears must break the recent low at 76,562 and firmly consolidate below the monthly thresholds at 79,773–75,446. Only then will new opportunities emerge for sellers.

If buyers attempt to regain control by reclaiming the weekly short-term trend level at 91,489, they may still struggle with the influence of the former consolidation zone centered around the 96,000–98,000 range. Surpassing this area would pave the way for Bitcoin to target a new all-time high at 109,986.

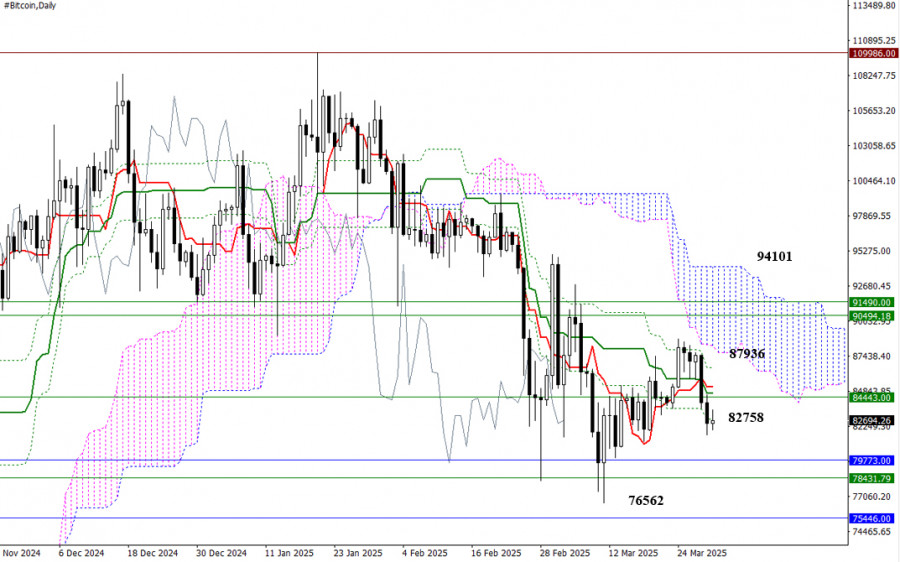

On the daily timeframe, the market is currently operating within the boundaries of the Ichimoku daily cross (87,936–82,758). Bulls must break through the overhead Ichimoku cloud (94,101) and consolidate in the bullish zone. The bears' targets and objectives are tied to higher timeframes and the abovementioned levels: 79,773 – 76,562 – 75,446.

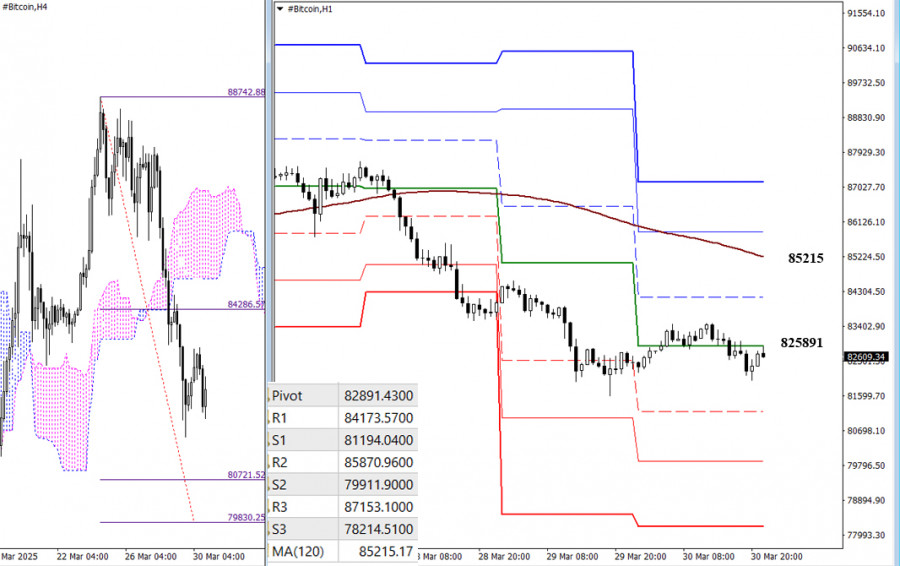

On the lower timeframes, bulls failed to reach the breakout target for the H4 Ichimoku cloud as bears regained key levels and pushed the price lower, forming a bearish breakout target for the H4 cloud at 80,722–79,830. Therefore, if the decline continues, the following points of interest will be the support levels of the classic Pivot Points and the H4 target zone. For bulls to regain momentum, they must initiate a corrective move upward and reclaim the weekly long-term trend level at 85,215. The placement of the classic Pivot Points, which act as the main intraday reference levels, is updated daily.

***

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.