Lihat juga

27.01.2022 12:00 PM

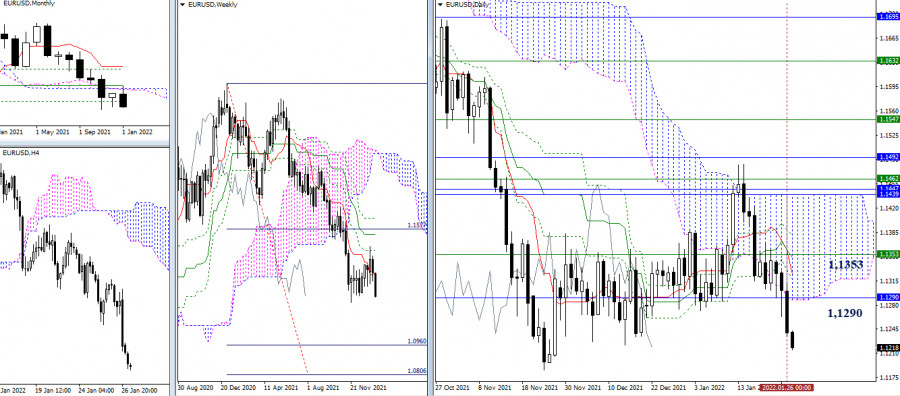

27.01.2022 12:00 PMEUR/USD

The bears implemented a decline. Now, their interests are focused on breaking through the minimum extreme (1.1186) and restoring the weekly downward trend. After that, attention can be directed again to the breakdown of the weekly downside target for the breakdown of the Ichimoku cloud (1.0806 - 1.0960). The levels of 1.1353 - 1.1290 (weekly short-term trend + final level of the monthly cross + daily levels), which we managed to break yesterday, still remain important. They still exert their influence and attraction on the situation.

The upward corrections during the previous days could not take away the main advantage from the bears, who continue to dominate and update new lows. As they further decline, they have reached the first support of the classic pivot levels (1.1213). The next support points are set at S2 (1.1186) and S3 (1.1137). The key levels in the smaller timeframes currently act as resistance, so they can come into operation with the development of the next upward correction. The key levels are now located at 1.1262 (central pivot level) and 1.1307 (weekly long-term trend).

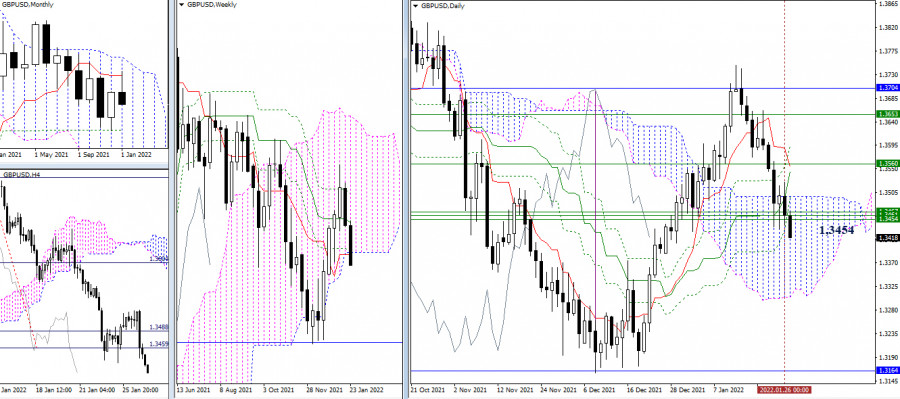

GBP/USD

Yesterday, the bulls failed to implement the emerging rebound. The pair returned to the support level of 1.3454 (accumulation of weekly levels) and try to break through it again. The downward pivot points here now include 1.3304 (lower border of the daily cloud) and 1.3164 (monthly Fibo Kijun).

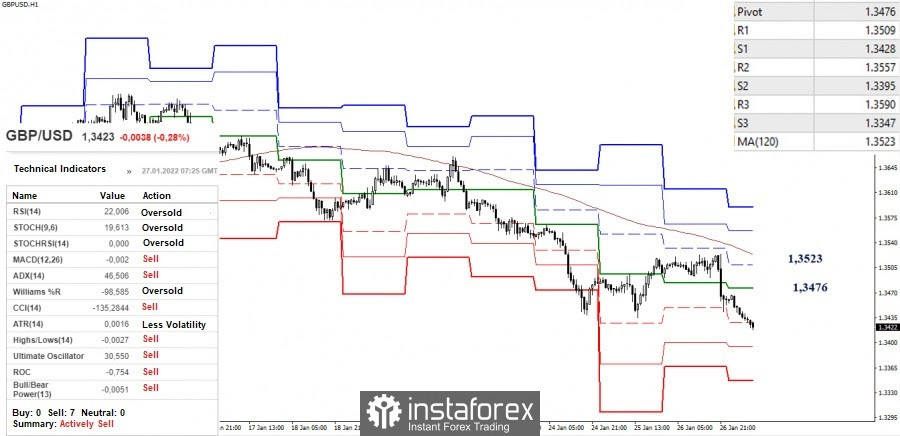

The correction ended in the smaller timeframes with the bears having the advantage. They are back in a downward trend. At the moment, S1 (1.3428) is being tested. The next pivot points for the intraday decline are the support of the classic pivot levels of 1.3395 (S2) and 1.3347 (S3), while the key levels responsible for the balance of power are seen at 1.3476 (central pivot level) and 1.3523 (weekly long-term trend). A consolidation above and reversal of the moving average can affect the current balance of forces.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.