26.06.2025 09:21 AM

26.06.2025 09:21 AM這種黃金再次得到支持是由兩個主要因素所驅動。第一個因素是德黑蘭和特拉維夫之間的談判持續存在失敗的風險。第二個因素與美國經濟逐漸陷入衰退、美元的持續疲軟,以及唐納德·特朗普關稅政策對全球未來影響的不確定有關,這種情況可能會持續一段時間。

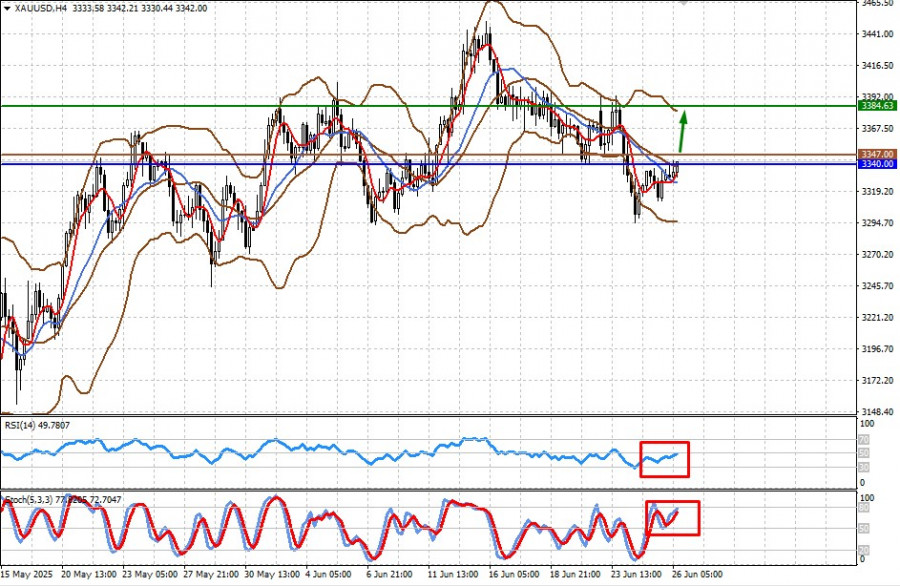

從技術角度來看,金價維持長期的上升趨勢。由上述原因推動的看漲動能,在突破並穩固在3340.00水平之上後,可能會持續。

價格正在布林帶的中線之上交易,並且高於5日和14日移動平均線(SMAs),這些線已經交叉並發出買入信號。相對強弱指數(RSI)正在穿越50%的標誌,也表示買入。隨機震盪指標(Stochastic Oscillator)位於50%以上,並持續上升。

在這種情況下,我認為應該買入黃金,潛在的上升趨勢目標可至3384.63。考慮到的一個可能買入點是在3347.00左右。