18.01.2024 08:29 PM

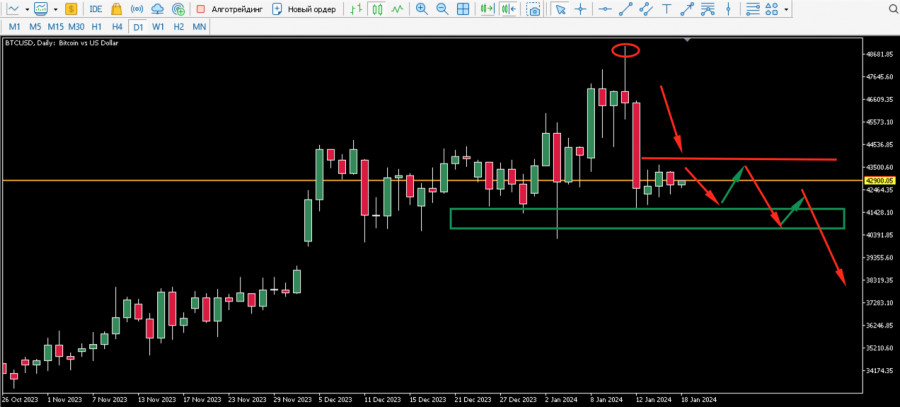

18.01.2024 08:29 PMBitcoin is approaching the end of the trading week in a state of uncertainty, as the asset failed to recover above $43k after a sharp collapse following the approval of the spot BTC-ETF. The cryptocurrency is consolidating near the $42.5k level, but any attempts to resume the upward movement end in a pullback. Simultaneously, sellers are intensifying pressure on the cryptocurrency's quotes, which may lead to further price decreases.

The news background also remains uncertain. Geopolitical and macroeconomic risks are strengthening the position of the U.S. dollar, creating additional pressure on Bitcoin's quotes. Overall, there is a situation where there are more reasons for further decline in BTC/USD than for consolidation or, moreover, resumption of the upward movement. However, to develop a long-term strategy, it is important to determine whether the BTC price decrease can be considered a full-fledged change in trend.

After the approval of the spot BTC-ETF last week, Bitcoin made an upward surge and updated the local price high at the $48.9k mark. Subsequently, the cryptocurrency faced a significant collapse to $41k amid substantial activation of sellers. Much of this process was conditioned by the fact that more than 90% of addresses were in profit, so portfolio unloading and further consolidation were inevitable. As of January 18th, Bitcoin had recovered above $42.5k and firmly established itself at this position.

The key support level of $40.5k also remains untouched, so there is no talk of a change in trend. This consolidation level is a key support for the BTC/USD movement to $48.9k, and its maintenance indicates relatively strong buyer positions above $40k. Analysts at Fidelity share a similar view, noting that the current BTC price drop is a short-term phenomenon associated with the approval of the BTC-ETF.

As of January 18th, this possibility exists, but it is minimal. Sellers tried to enter the support zone of $40.5k–$40.8k, but to no avail. This support zone was the main accumulation cluster for bulls before the move to $48.9k, so a smooth breakthrough of it seems unlikely. Considering that the market is currently quiet, related to a period of consolidation, and uncertainty regarding the Federal Reserve's policy, a spike in volatility in the crypto market should not be expected.

As of writing, Bitcoin is under pressure from sellers who continue to unload portfolios. Geopolitical instability strengthens the U.S. dollar index, putting pressure on cryptocurrency quotes. In total, the current decrease and stagnation of Bitcoin are related to the coincidence of several factors that have provoked a local lull and pause in the market. There is no talk of a global trend change, but the possibility of BTC breaking the $40k level remains.

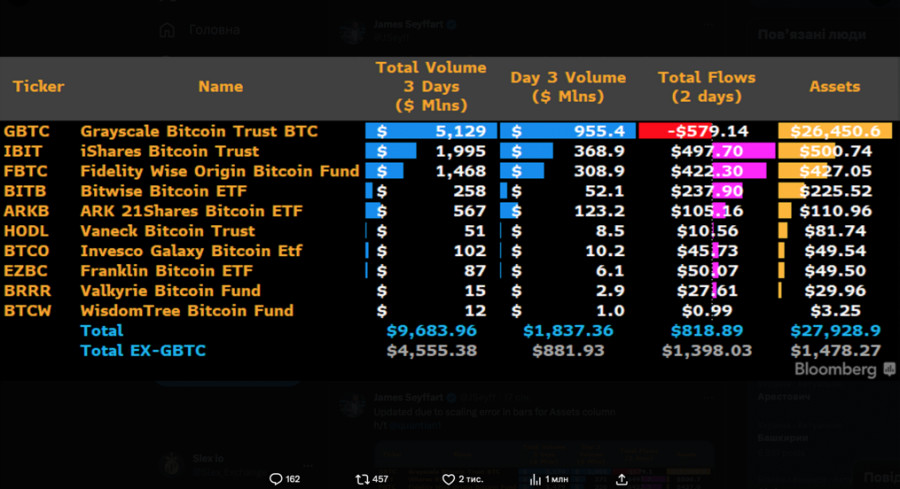

The trading volumes of spot BTC-ETFs have reached the $10 billion mark, which will positively affect the capitalization of the crypto market and Bitcoin in the medium term. For now, investors are following the rule of "buy he rumor, sell the news." Given the scale and period of accumulation, it's clear that portfolio unloading will also take time. However, alongside this, major funds and other institutional investors are investing in BTC through ETFs.

ProShares has filed applications for registration of five new BTC-ETFs, including a leveraged product, which could further increase trading volumes in the BTC market. Another BTC-ETF issuer, BlackRock, announced that it continues to buy Bitcoins, including to back the spot BTC-ETF. Company representatives stated that the investment giant's balance sheet includes about 16,000 BTC, totaling over $700 million.

The inertial unloading of portfolios by large and short-term investors following the approval of the spot BTC-ETF, along with macroeconomic and geopolitical tensions, has led to a local lull in the Bitcoin market. As of January 18th, there is a large-scale process of consolidation and capital redistribution in the BTC market. It is quite possible that as part of this process, the price of Bitcoin will break the $40k level, which will prolong the consolidation process and may lead to a deeper correction. However, until this happens, the cryptocurrency is within an upward trend, and the medium-term target should be set at a movement to $50k.

比特幣在創下歷史新高後,隨後於美國交易時段大幅下跌,持穩在117,100水平附近。若跌破此水平,將對當前的牛市周期造成重大衝擊。

[Solana] – [2025年8月15日 星期五] 隨著 EMA (50) 和 EMA(200) 出現黃金交叉,且 RSI (14) 處於中性看漲水平,Solana 很可能在整日內走強。 關鍵水平 1. 阻力位 2: 219.20 2. 阻力位 1: 205.78 3. 樞軸: 196.39 4. 支撐位 1: 182.97 5. 支撐位 2: 173.58 戰術情境 積極反應區域:如果價格突破並收盤在 196.39 之上,Solana 有潛力繼續走強至 205.78。

比特幣已從其「高位」下滑,目前的交易價格約為 $121,600。昨天明顯缺乏大型買家的情況,使得這一領先的加密貨幣可能進一步調整。

以太坊昨天大幅上漲,僅差一步就刷新了其歷史新高,達到4,785標記。比特幣則在各種挑戰下,昨天也設法突破了歷史新高,達到124,533,隨後回落至122,000以下。

以太幣的價格即將觸及歷史新高之際,Ethereum Foundation已開始逐步出售其持有資產。這一舉動確實引起了人們的疑惑,並提出了一些關於該組織戰略意圖的問題。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.